When a client asks for pricing, you’re already on the clock. Take too long, and the job goes elsewhere. Move too fast with numbers you can’t defend, and you spend the rest of the project absorbing costs you never planned for.

This is the kind of bind that small residential builders live in. Speed determines whether you stay competitive. Market volatility determines whether the job stays profitable. And when inputs shift, scope evolves, dealer pricing changes, and timelines stretch, the estimate has to change with them.

The problem is that many construction cost estimates are built as fixed snapshots. They produce a number, but they don’t carry the assumptions, inclusions, and cost drivers forward when conditions change.

This guide explains how construction cost estimates work, what a defensible estimate should include, and how to build estimates that remain explainable and controllable even when the numbers change.

What is Construction Cost Estimating?

Construction cost estimating is the process of projecting the cost to complete a construction project and deciding whether to take on the job. It informs whether to pursue the work, how to price it, and what margin you can realistically protect as conditions change.

A good estimate doesn’t just produce a number. It documents the cost drivers behind that number so you can explain, revise, and defend it when the client asks why pricing has moved.

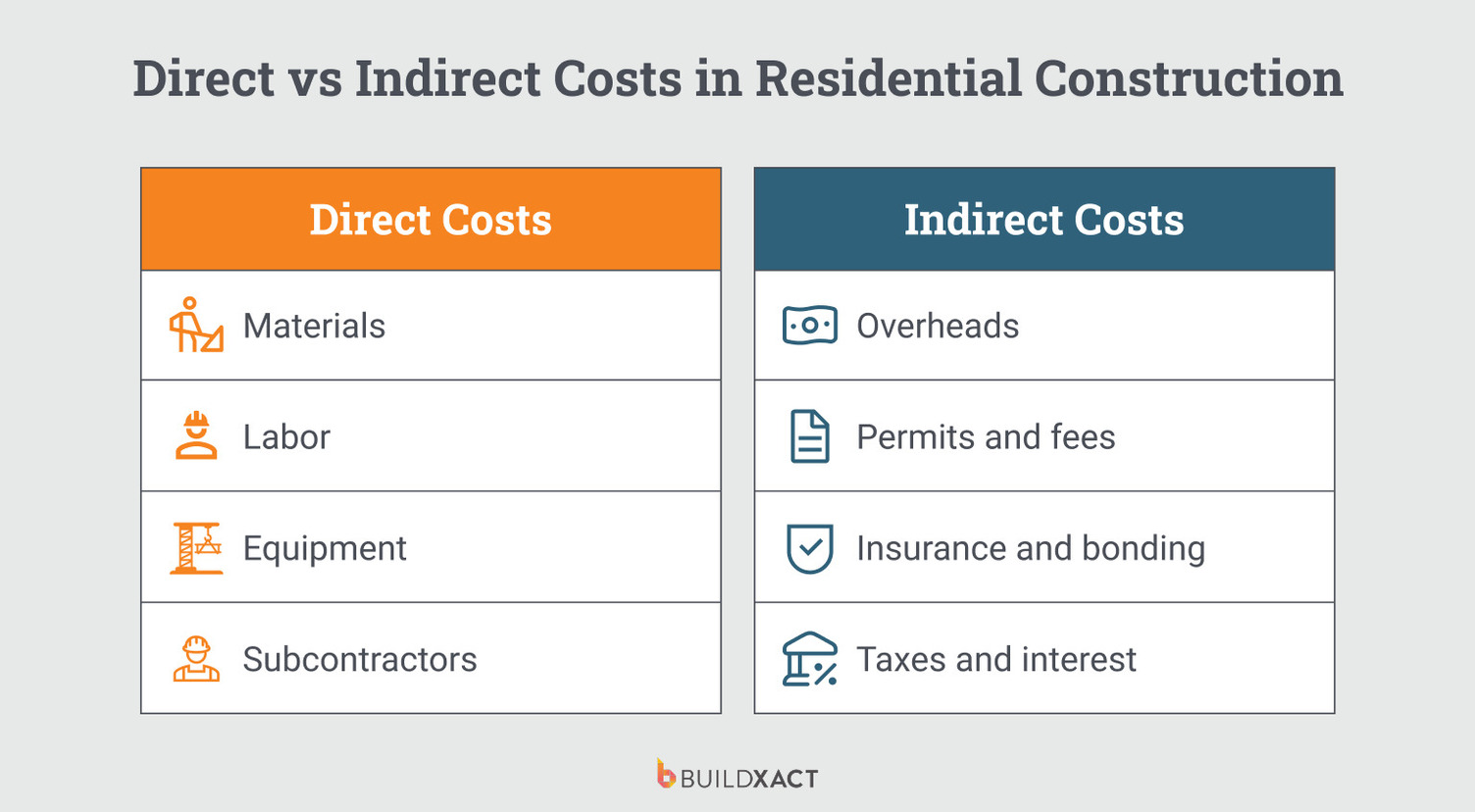

A complete construction cost estimate typically includes three cost categories:

- Direct costs: Materials, labor, subcontractors, and equipment — expenses tied directly to the build.

- Indirect costs: Overheads, permits and fees, insurance and bonding, taxes, and interest costs that support the project but aren’t task-specific.

- Other costs: Profit and contingency, your margin, and your buffer for uncertainty.

Knowing what belongs in each category isn’t usually the hard part. The challenge is keeping those costs aligned as inputs shift: dealer pricing changes, scope evolves, timelines stretch. When estimates aren’t built to carry those changes forward, margins erode and explanations get harder once the job is underway.

The importance of accurate construction cost estimating

A missed estimate ripples through the rest of the business, tightening cash flow, pushing schedules off track, and forcing homeowners to ask questions you don’t yet have clear answers to.

For small builders running several jobs at once, a single estimate drifting off plan can force last-minute adjustments across schedules, orders, and invoices for other projects.

Accurate estimating is about keeping the operation stable as conditions change by;

- Protecting cash flow stability. When estimates align with actual costs, payments track spending rather than forcing you to float overruns while waiting on draws.

- Building homeowner confidence. Fewer reactive budget conversations. Fewer surprises. The job feels controlled rather than improvised.

- Supports competitive bidding. You can price work quickly without padding numbers or guessing, and explain how you arrived at the price.

- Preventing schedule disruption. Quantities and sequencing are clear enough that materials arrive when needed and trades aren’t left waiting.

- Improving day-to-day efficiency. Less time re-checking spreadsheets, fixing omissions, or rebuilding bids after something was missed.

- Enabling confident scaling. When estimating is repeatable and traceable, adding another job doesn’t create proportionally more chaos.

The catch is that accuracy only holds if the estimate can adapt. A number that looks right on day one but falls apart when lumber prices move, or scope evolves, is a static snapshot you’ll be forced to rework under pressure.

When is the Right Time to Estimate a Job?

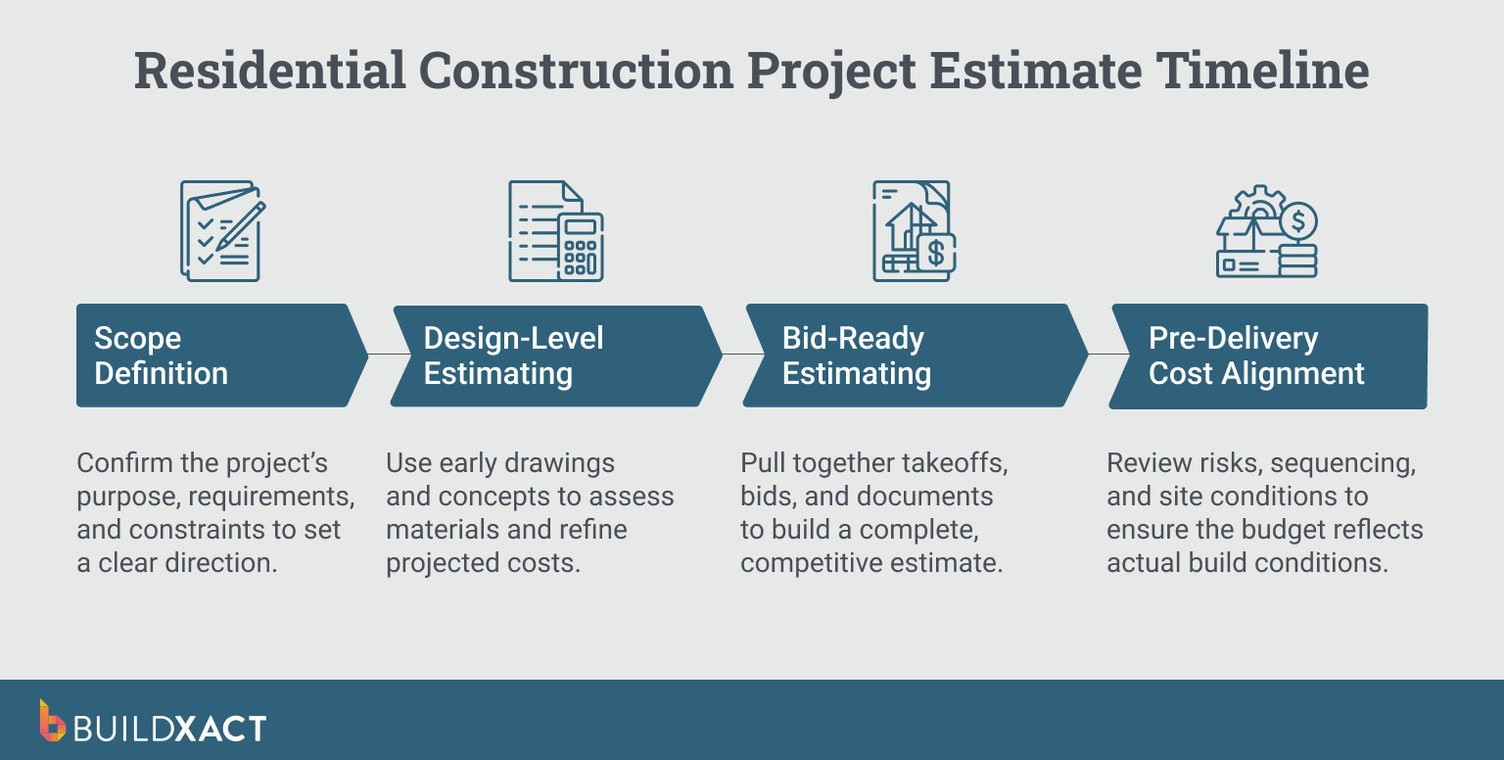

Cost estimating doesn’t happen once. It happens in stages, as information becomes clearer and risk shifts.

Ideally, an early estimate before construction begins to decide whether a job is even viable. But that number should guide decisions, not lock pricing. A detailed construction cost estimate becomes a commitment only when the scope, pricing, and assumptions are clear enough to defend.

Begin estimating once the project scope is defined

The first step is agreeing on the project scope, often called an order-of-magnitude estimate. This is where you clarify client expectations, overall size, complexity, and major constraints: zoning, site access, regulatory requirements, and specialty requirements that affect cost.

At this stage, you’re deciding whether the job makes sense to pursue. A client says, “simple addition.” You estimate based on that assumption. Three weeks later, the plans show a kitchen relocation, the removal of a load-bearing wall, and an upgraded electrical panel. The original was intended to answer a different question.

Problems start when early directional estimates are treated as fixed prices.

Refine the estimate during the design stage

Once the project scope is agreed on, design work begins. Estimating at this stage incorporates materials, methods, and schematic details to test constructability and cost alignment. These estimates feed directly into the bidding documents.

This is where risk becomes visible. The framing you assumed gets engineered differently. Allowances collide with real finish selections.

Adjusting the estimate here protects you. If you fail to make the necessary adjustments, you’ll have to explain cost increases after construction starts when flexibility is gone, and trust between you and your client is harder to maintain.

Finalize the estimate when preparing your bid

When preparing a bid, the estimate consolidates all available inputs: takeoffs, subcontractor quotes, dealer pricing, direct and indirect costs, and target margin into a defensible number.

For some projects, this is the final estimating stage. Even if the bid isn’t accepted, the time and effort invested still carry a cost that must be recovered across awarded work.

This is where the estimate turns into a commitment. The number you submit is the one you’ll be measured against.

Price too high, and you lose the job. Price too low, and you win work that erodes your margin. At this stage, defensibility matters more than speed.

Update estimates as you plan for project delivery

Project control estimates are prepared after contract signing but before construction begins.

They support sequencing, risk review, and planning, so execution starts with realistic cost expectations.

The contract is signed, but work hasn’t started. Site access turns out tighter than expected. The demolition scope is larger than the drawings suggested.

This is the last opportunity to correct assumptions before costs become real. Miss it, and you absorb the difference in the field.

Each estimate serves a different purpose. Early estimates help you decide whether a job is worth pursuing. Later estimates commit you to a price you’ll be held accountable for.

Estimating breaks down when a rough number is treated as a final one, or when a final estimate has to absorb changes it was never built to handle. A good estimating process lets you update assumptions and costs without having to rebuild the estimate from scratch.

Construction Costs to Include

You need to account for both direct and indirect costs. Direct costs include labor, materials, equipment, and subcontracted work. Indirect costs cover overhead like permits, insurance, admin time, utilities, and the cost of preparing bids, including the ones you don’t win.

Most estimates come from treating variable costs as fixed, because that’s where they look right on paper, but fail in the field.

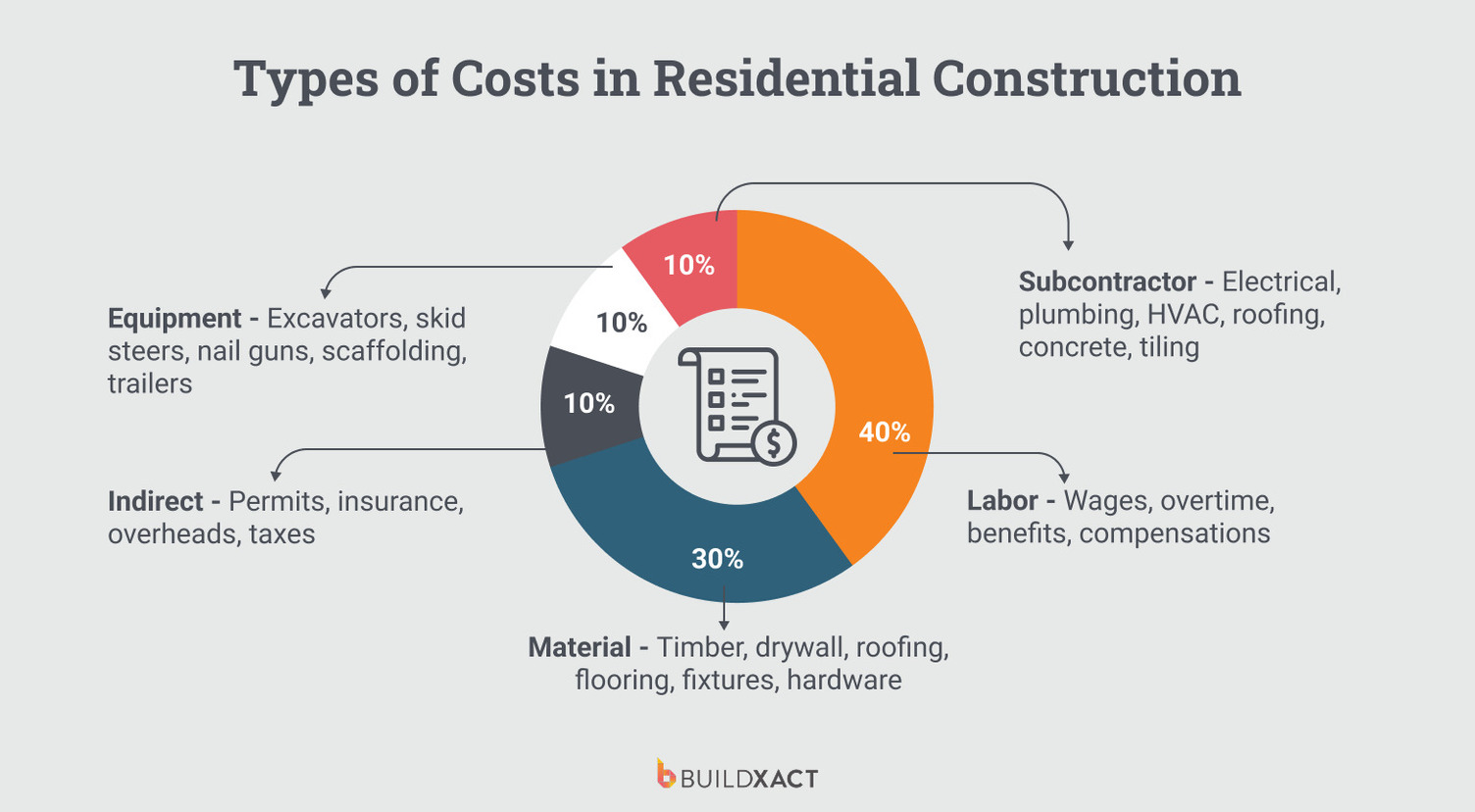

Labor costs

Labor is one of the largest cost drivers on a construction project, often accounting for nearly half of the total job cost. Estimating labor is about understanding how time affects those hours.

When start dates slip or schedules stretch, labor costs move with them. A January start can be delayed by weather, extending the job. A project starting six months from now may begin after a wage increase you didn’t carry. The original hour count may still be right, but the conditions it depended on have changed.

Historical data helps, but only if it reflects what similar jobs actually cost once time and delays are accounted for, not just what was originally bid.

That’s why labor estimates need allowances for timing and duration risk, especially on longer jobs or projects with delayed starts. Labor overruns usually come from schedule changes, not bad math.

Material costs

A quantity takeoff lists every material required to complete the project: doors, timber, drywall, fixtures, wiring, tiles, and hardware. Accurate measurement is essential to avoid gaps between estimated and actual costs.

Material pricing must account for unit costs, quantity discounts, delivery fees, and price escalation. Whether pricing by unit or by linear length, accuracy is essential for producing a reliable construction cost estimate.

Counting materials isn’t enough because prices change, delivery costs add up, and bulk rates change the math. A takeoff you ran weeks ago may already be outdated.

Verifying quantities digitally reduces errors and rework. More importantly, it allows you to update pricing quickly when costs change, instead of rebuilding the takeoff from scratch and hoping nothing else has moved.

Equipment costs

Equipment costs include anything you buy, own, or hire to complete the job, as well as the costs of using it, such as transport, fuel, maintenance, and on-site security.

Excavators, skid steers, nail guns, scaffolding, and trailers don’t just carry a day rate. They carry time risk and transport, which eat into the margin, while fuel costs add up. Leaving equipment on site also introduces storage costs and theft exposure.

The real decision is between hire and buy, and it depends on duration and utilization. If you need a machine for two days, rent it. If it appears on most jobs over the next year, ownership may make sense. Equipment costs break estimates when convenience replaces utilization math.

Subcontractor costs

Most residential projects rely on specialist trades such as electrical, plumbing, HVAC, roofing, concrete, and tiling. Their pricing and availability should be included in your estimate.

When you build an estimate, you’re pricing against an assumed schedule: when each trade starts, how long they’re on site, and how the work sequences.

If a subcontractor is booked out for six weeks, that schedule no longer holds. The job stretches, downstream work waits, and site overhead keeps running longer than planned: supervision, temporary facilities, insurance, and admin time don’t pause just because a trade is late.

Unclear scope makes this worse. When expectations aren’t defined upfront, gaps fill mid-job through change orders, after pricing has already been committed, and leverage is lost.

Get subcontractor quotes early, define scope in writing, and align availability with your planned sequence. Otherwise, delays turn into extended overhead, rework, or repricing, and the estimate absorbs the difference.

Indirect costs

Indirect costs support the job without being tied to a specific task; permits, insurance, administrative time, waste removal, site toilets, and temporary fencing. Because they don’t show up on a takeoff, they’re easy to overlook or underestimate.

But these costs don’t disappear. They run for as long as the job runs. When schedules stretch, indirect costs stretch with them, showing up later as overhead on the P&L rather than as line items in the estimate.

Tracking indirect costs consistently across jobs turns them from guesses into known quantities. That’s how you forecast more accurately and avoid quietly absorbing overhead that should have been priced in from the start.

When you miss indirect or fail to update them as conditions change, the estimate looks accurate. However, the failure shows up later, in budget conversations, schedule pressure, or the margin you give back without realizing where it went.

Different Types of Estimates

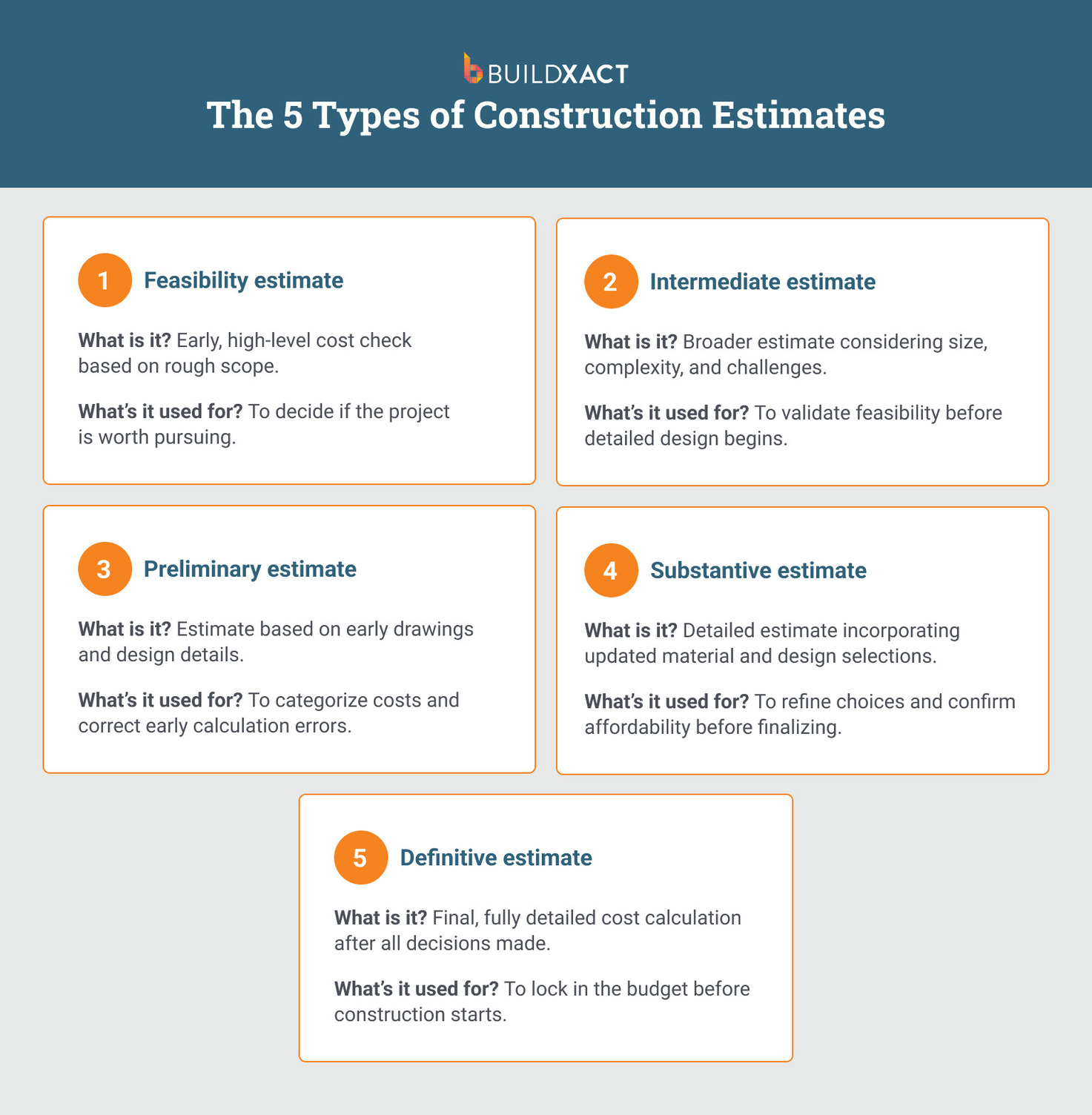

Construction projects use different types of cost estimates at different stages because each one answers a specific question. Early estimates help decide whether a job is worth pursuing. Later estimates support pricing decisions you will be held accountable for.

Problems arise when an estimate is used outside the stage for which it was built, such as treating a rough number as a commitment or expecting a final price to absorb early uncertainty.

Feasibility estimate

The feasibility estimate is a high-level estimate used to decide whether a project makes sense to pursue. At this stage, the goal is to assess overall scope, complexity, and fit before investing time in detailed pricing.

This is the least precise estimate and relies mainly on historical data and past experience. Its purpose is not to produce an accurate price, but to determine whether the job is worth moving forward with.

In residential work, this might mean deciding whether a second-floor addition is structurally and financially viable before spending hours preparing a detailed bid.

Intermediate estimate

Once you prove the feasibility of a project, the intermediate estimate takes a closer look at size, scope, and complexity. It considers likely challenges and constraints, but still relies more on experience and benchmarks than on finalized documentation.

For an extension, identify access issues, demolition complexity, or sequencing challenges that could complicate the build if missed early.

Preliminary estimate

The preliminary estimate incorporates early design or blueprint information. Costs are now categorized and tied to specific building elements, allowing obvious errors or omissions to be identified and corrected.

On a new build, early floor plans let you start pricing framing, roofing, and finishes. The numbers are still approximate, but they are now grounded in actual design.

Substantive estimate

The substantive estimate is prepared after you agree upon the design. It uses more accurate material pricing and a finalized scope, allowing informed trade-offs between cost and finishes.

This is typically the last stage where meaningful changes should be made.

At this point, you compare real options such as siding types, flooring selections, or fixture upgrades using current dealer pricing. If the client wants to upgrade, you can show the cost. If they need to reduce spending, you know where to do it.

Definitive estimate

The definitive estimate is created after you sign the contracts and resolve all changes.

Quantities, labor, and subcontractor costs are also finalized, so this estimate serves as the baseline for construction.

For a kitchen or full-home renovation, this means locking final quantities, labor, and subcontractor pricing before work begins. These are the numbers the job will be built and billed against.

Each estimate supports a different decision. Skip a stage, and you either spend time pricing jobs that were never viable or commit to numbers before the scope is clear.

The Hidden Costs of Manual Estimating

Traditionally, construction cost estimates were built by hand with a calculator and paper. The process required experience and time, and even small errors could compound into serious cost problems by the time construction began.

Spreadsheets improved organization, but not the underlying process. Estimates still depended on manual inputs and broke when scope, timing, or pricing changed.

The real issue with manual estimating is visibility into the process. When estimates don’t update or align with outcomes, hidden costs show up later as lost bids, schedule issues, cash-flow pressure, and margin loss, making them hard to trace and correct.

Slow, inconsistent bidding

The cost is the bids you never get a response to. While you measure plans and update spreadsheets, another builder submits pricing first. You do not always receive a rejection. You simply do not hear back. Because you cannot see what you lost due to turnaround time, the impact stays invisible and continues.

Frequent cost overruns

When a job runs over budget, the estimate rarely gets blamed. The overrun gets attributed to a subcontractor who took longer, a dealer who raised prices, or a client who changed the scope. Without comparing the bid to the actual costs line by line, you cannot see where the estimate missed the mark. The same gaps show up on the next job under different materials, a different scope, and the same missed costs because nothing changed in how the estimate was built.

Unstable cash flow

Cash flow problems often look like payment problems. You assume you need better terms, faster-paying clients, or more credit. In many cases, the estimate created the gap. You bid a number without accounting for when costs would be incurred and when payments would be received. You feel the cash squeeze later, long after the estimate was finalized, which makes the root cause hard to spot.

Subcontractor misalignment

A subcontractor arrives and cannot start because materials are not on site, or they leave because the job is not ready. It looks like normal scheduling friction. In many cases, the estimate set it up.

Quantities were off, lead times were not reflected in the sequence, or the scope was not defined clearly enough to plan the handoffs. The cost does not appear as an estimating error. It appears as delays, rescheduling, and lost time.

Pricing blind spots

The spreadsheet holds the price you entered on the day you made the bid. Material costs can change between the bid and the purchase. Lumber, drywall, fixtures, and hardware costs move. The estimate does not adjust unless you update it. The cost remains hidden until invoices arrive, by which time the margin is already gone.

High admin load

Manual estimating creates administrative work that most builders don’t track. Time goes into rechecking formulas, copying line items, updating the same cells, and rebuilding similar estimates from scratch. Because you don’t bill this time and rarely record it, the cost is spread across evenings and weekends. It’s real capacity, but it never shows up as a line item.

As Gartner’s research on construction software buyers puts it: “Without automation, construction managers end up spending excessive time on administrative tasks rather than focusing on strategic decision-making.”

That’s the trade-off: hours spent maintaining spreadsheets instead of running jobs.

Hard to scale

Manual estimating sets a ceiling that can be hard to see while you are busy. Every new job requires the same estimating effort. As volume increases, quoting becomes the bottleneck. The cost is not an expense you can point to. It is the work you do not bid, the opportunities you do not pursue, and the growth you do not reach.

None of these costs show up on a profit and loss statement as estimating errors. They appear as missed bids, schedule pressure, cash flow strain, and margin loss. That is why they persist. Manual estimating hides the link between estimate decisions and job outcomes, so builders treat the symptoms rather than the underlying problems.

Why Digital Estimating Outperforms Spreadsheets Every Time

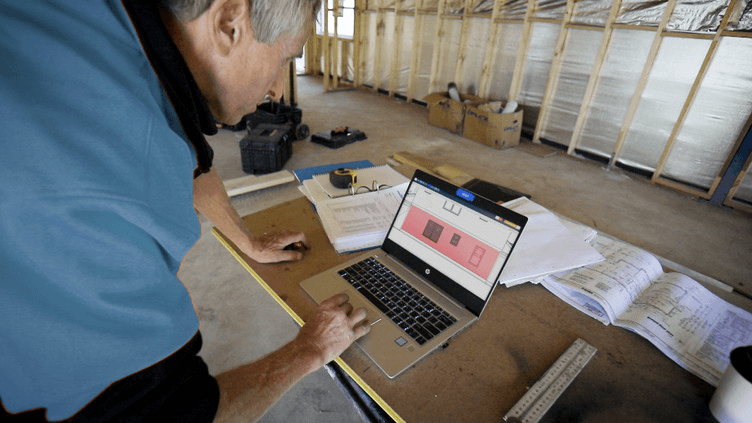

Manual estimating hides costs by separating the estimate from what actually happens on the job. Digital estimating fixes that by keeping quantities, pricing, schedules, and updates connected. The result is not just faster bids, but fewer surprises once work begins.

Faster quoting and consistent turnaround

Slow quoting rarely shows up as a clear loss. Clients simply stop responding. The bottleneck is not judgment. It is measurement and rework. Manual takeoffs require estimators to recalculate the same quantities whenever a plan changes or a new option is considered.

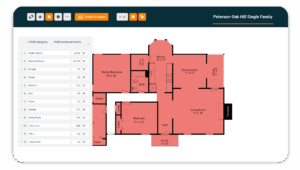

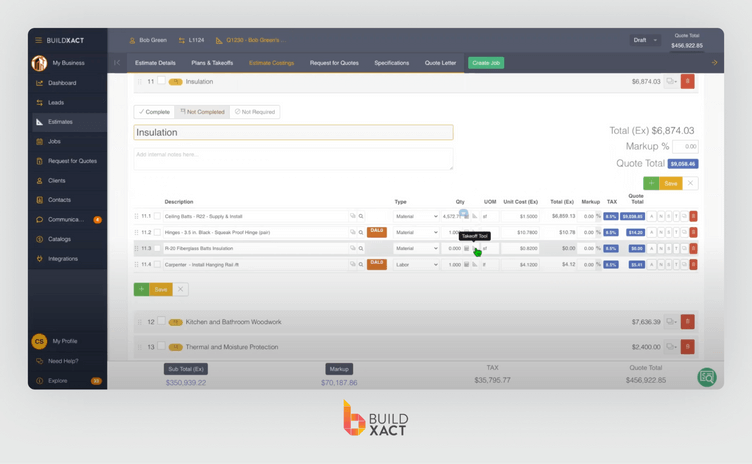

Digital estimating removes that bottleneck by automating takeoffs. Quantities are pulled directly from plans and reused across scenarios, so estimates evolve instead of being rebuilt. This is what turns multi-day bids into same-day or next-day responses.

Slates’s construction tech landscape report shows why this matters: modern AI systems can process full drawing sets in minutes with high accuracy, eliminating weeks of manual measurement and reducing missed scope. That shift makes same-day or next-day quoting possible without sacrificing reliability.

Just Building Group reduced estimating turnaround from weeks to days by replacing manual takeoffs with Buildxact’s digital takeoff tools. According to estimator Steve Griffin, faster bidding often made the difference in winning work because clients stayed engaged while the decision was still active.

“That often makes the difference when closing a new customer. In this environment, time is of the essence. The quicker we can get a bid out to a client, the less cold they go.”

— Steve Griffin, Estimator, Just Building Group

Fewer estimating errors and omissions

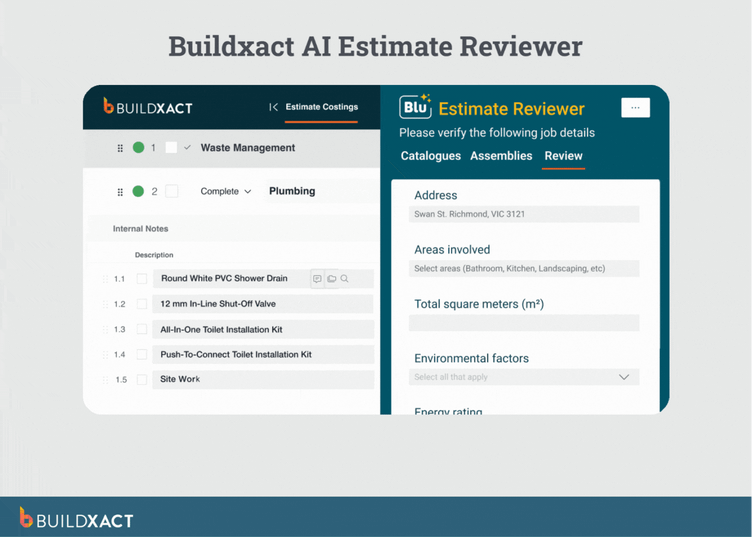

Manual estimates miss items, and those gaps usually surface after work has started. Digital estimating reviews the estimate before it leaves your desk. Automated checks flag missing line items, calculation issues, and quantity mismatches.

Errors that used to appear mid-job now appear on screen, when they are still easy to correct.

More stable and predictable cash flow

Cash flow problems often start in the estimate. Quantities change, costs shift, or timing assumptions do not align with how money actually flows through the job.

With Buildxact, estimates, schedules, and cost tracking stay linked. When quantities change, the totals update accordingly. You are not chasing gaps created months earlier in a disconnected spreadsheet.

Smoother subcontractor coordination

Subcontractors waiting on site or leaving because work is not ready usually point back to estimating assumptions. Quantities were wrong, lead times were missed, or sequencing did not reflect reality.

Digital takeoffs feed directly into schedules. There is no re-entry or copy-paste. Trades arrive when the job is ready because the estimate and the schedule are built from the same data.

Accurate pricing with no cost blind spots

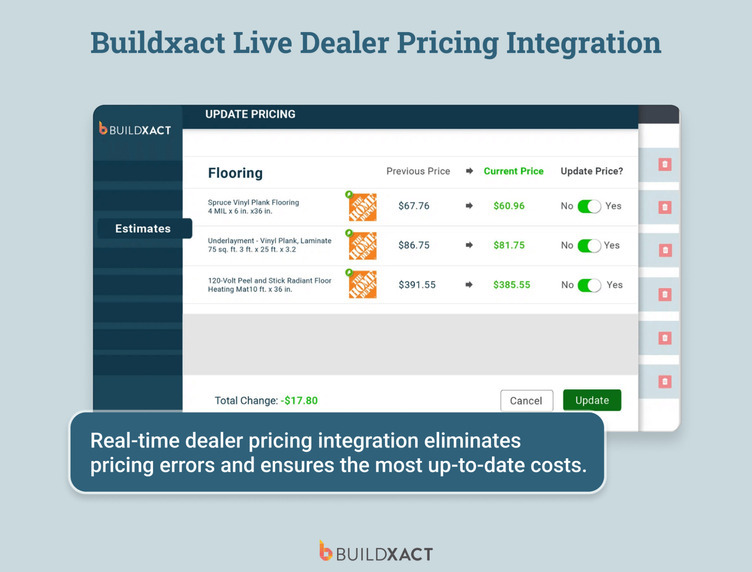

Margin often disappears between the day a bid is sent and the day materials are ordered. Prices move, but spreadsheets stay frozen.

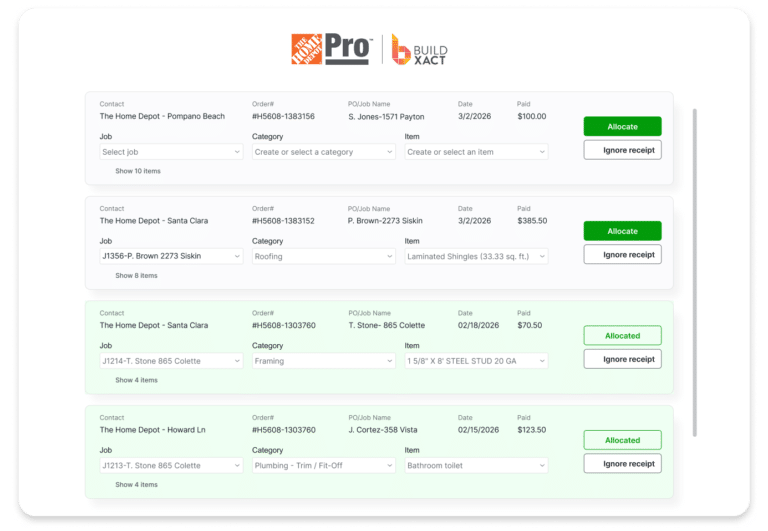

Buildxact pulls live dealer pricing into the estimate. The price you bid reflects current costs, not outdated numbers carried forward from a previous job.

Lower admin load across every estimate

Rechecking formulas, copying line items, and updating cells is administrative work, not estimating. Because it is rarely tracked, it quietly consumes time outside of billable work.

Buildxact replaces this rework with reusable assemblies and templates. Jobs you have priced before do not need to be rebuilt. Time spent maintaining spreadsheets is time taken away from managing projects or reclaiming evenings.

Scalable, repeatable estimating as workload grows

Manual estimating limits capacity because each estimate takes the same effort regardless of volume. Growth stalls at the quoting stage.

Templates standardize pricing and logic across jobs and team members. Estimating no longer depends on a single person rebuilding the numbers each time. Capacity increases without a matching increase in admin.

Improve The Estimating Process With Building Estimating Software

Accurate estimating does not require decades of experience or a deep dealer network. It requires a system that keeps quantities, pricing, and timing aligned as projects change.

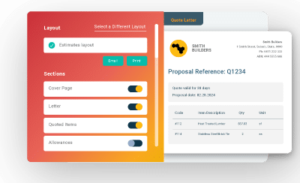

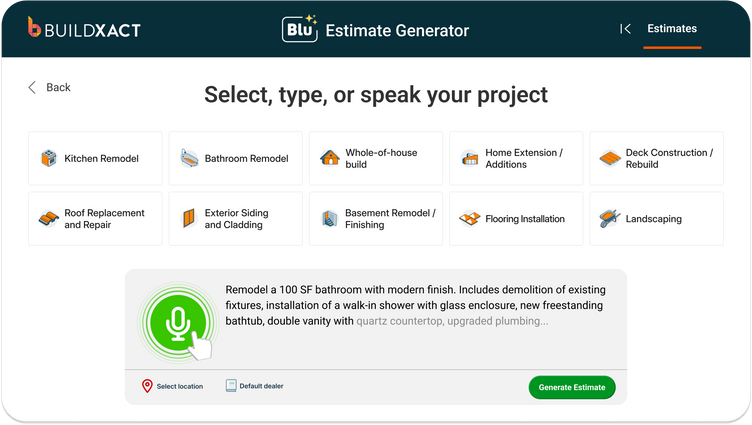

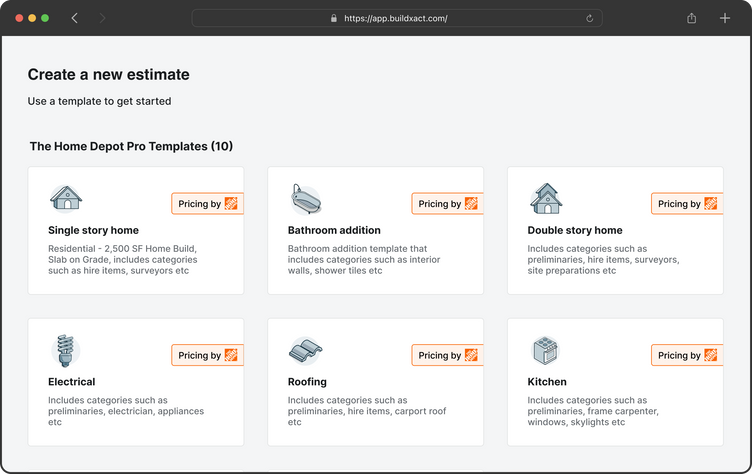

Buildxact’s estimating and construction management software connects estimating, bidding, cost tracking, and scheduling in one place. Estimates update as inputs change, rather than breaking.

For small residential builders and growing teams alike, this means faster turnaround, fewer errors, tighter margins, and an estimating process that scales with the business.

Book a demo or start a free trial to see what estimating looks like when costs stay connected from bid to completion.